Introduction

Hello friends,

Greetings from Vinit Parekh. I hope you're doing well, so let's come to the topic. This is the one of that topic which I was really very curious about. You might have heard of bubble bust in stock market if not then I'm going to cover that topic for you. We have seen a lot of recessions in the past. For an example let's say in year of 2000's DOTCOM bubble bust , 2008's financial crisis which we call the great recession , recently we have seen COVID recession. For now let's understand DOTCOM Bubble Bust briefly so follow along with me.

What is Bubble?

Bubble is the some amount of air or gas within liquid right? well this is absolutely correct but here I'm taking about Stock market bubble. so Bubble in stock market refers to

A situation where the price for something—an individual stock, a financial asset, or even an entire sector, market, or asset class—exceeds its fundamental value by a large margin.

When did Dotcom Bubble happen?

The dotcom bubble was a rapid rise in U.S. technology stock equity valuations fueled by investments in Internet-based companies in the late 1990s.

How does Dotcom Bubble effected the U.S. market?

The value of equity markets grew exponentially during the dotcom bubble, with the Nasdaq rising from under 1,000 to more than 5,000 between 1995 and 2000.

In 2002 ( within 2 years ) that value of equity markets decreased by 80%

Now here we might have 2 following question,

1 ) Why the value of NASDAQ is hiked suddenly fall down?

2 ) How it comes to the bottom abruptly?

So now let's find the answers of those questions.

How was the Dotcom bubble formed?

In the year of 1990s, there was a rush of internet companies. There was very specific speculation, which means many people have started an investment in internet companies. This resulted in the Dotcom bubble forming and between 1999 to 2000 it touched it's peak by crossing 5000.

So this is the simple and short explanation of Dotcom bubble.

How it was started?

We have to go to the past to gain brief knowledge about Dotcom bubble's beginning.

In 1989, the worldwide web was started which is also known as WWW. Most of every websites that we see on the internet starts with www and ends with a dotcom

In 1991 WWW was published through which an average person can also reach on it.

To make an internet user-friendly web browser was introduced, the first web browser was named as The WorldWideWeb.

After web browser was published many internet companies started arriving. People started assuming that everything will be going to the internet ( online ) and it was not wrong in many aspects.

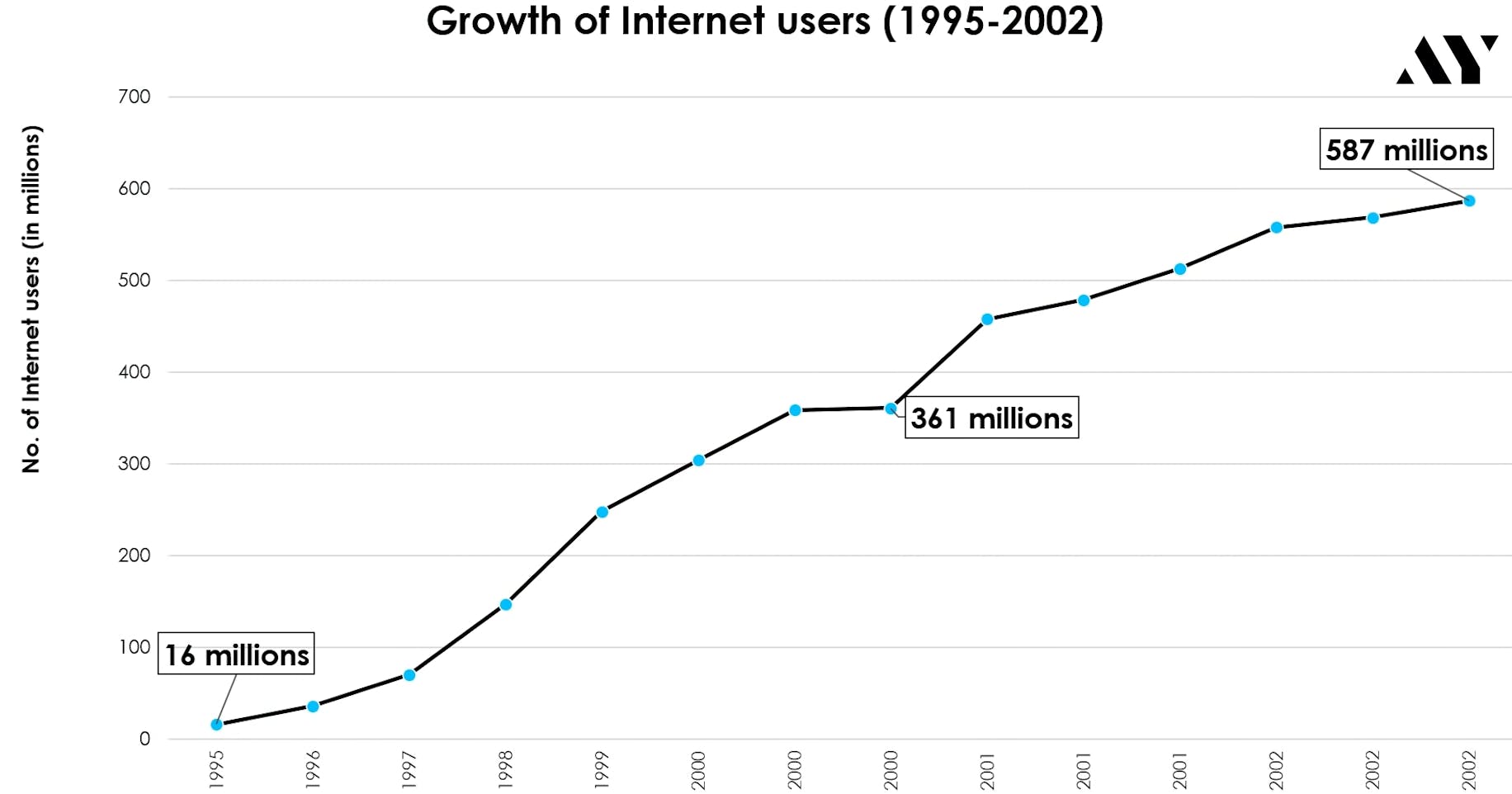

As we can clearly see from the above graph the Internet users were increasing very fast

As we can clearly see from the above graph the Internet users were increasing very fast

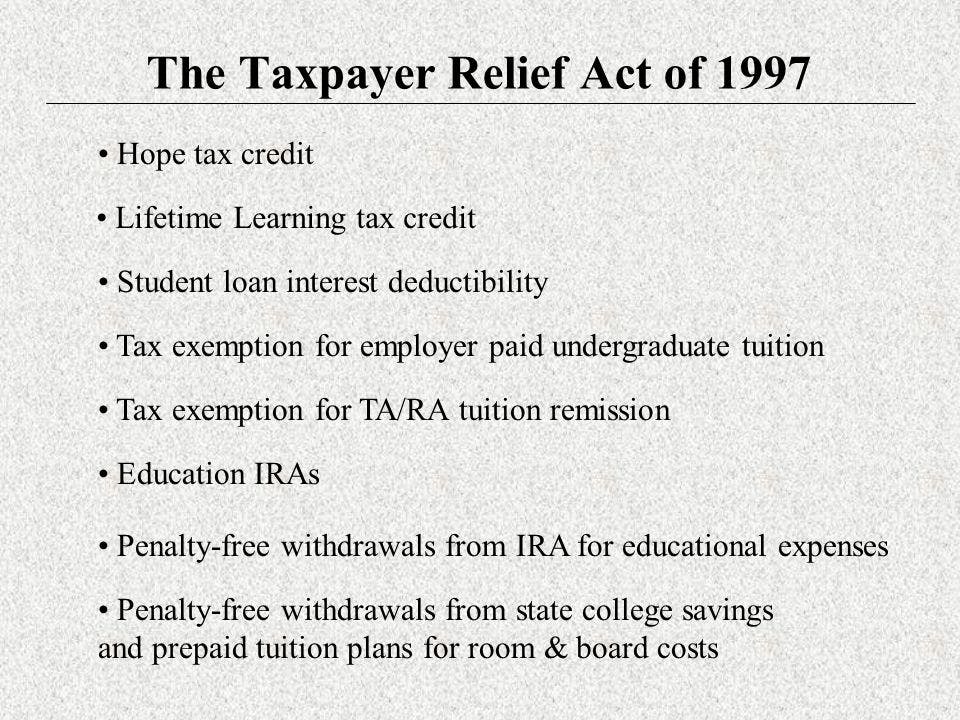

In 1997 Taxpayer Relief Act came into the picture in which tax was reduced in capital gains. This means people started investing more with more returns by paying less or minimal amount of tax.

So many internet companies has decided to list themselves in the stock market. IPOs of the tech companies were in demand which was penetrative in stocks. Companies like Yahoo and Ebay were planning to merge.

The target of those companies were to increase the funds and expend themselves by marketing and advertising. Whether they make operational profits or not, their product's quality was good or not, they are not focused on that. The entire focus was dedicated to increase their growth.

That time their motto was:

"Get large or Get Lost"

in spite of increasing large number of internet users but not that much. In the year of 2000s there were around 300 million users, but the website were 17 million. This all website companies are targeting ( chasing ) those limited people.

Key factors of Dotcom bubble escalated:

Higher user expectations: All of this internet company was assuming that number of internet user will be increased by 10 times in sort of time but it didn't happened that quickly as quickly the number of companies were increasing.

Overvalued Tech Companies: Profit number , fundamentals of business were neglected by these internet companies, they were focusing on the increasing web traffic , how many people are coming to their website. So these are their main concern of those companies.

Media Hype: Media is talking all over about internet companies & internet entrepreneur's. So the interest of people were increased. On one side number of internet entrepreneurs were massively raising. On the other side investors also increasing in it, there were so many retail investors have come in it. Too many funds were raised in IPO's.

No viable products: As we discussed earlier, companies were less careful about their products. The first task of the company was to raise funds whether they had a product or not and ultimately from these funds they will have a good product. This kind of mentality was they were having.

Misusing of funds: Although Internet companies were raising too much fund then one of the major question comes to the mind is that "Where they were spending that much money?" Major stack of money were being spent on marketing and advertising. On the other side, lavish offices were being opened, lavish parties were being organized. Employees of those companies were being sent on an exotic vacation.

How Dotcom bubble was popped?

Due to interest rates were low in U.S this bubble was formed but in the year of 1999 two major changes were happened.

Due to interest rates were low in U.S this bubble was formed but in the year of 1999 two major changes were happened.

- Y2k bug

- Rising interest rates

- Y2K bug: So what is Y2K bug? Y2K bug, also called Year 2000 bug or Millennium Bug, a problem in the coding of computerized systems that was projected to create havoc in computers and computer networks around the world at the beginning of the year 2000. Worldwide, $308 billion ($485 billion) was estimated to have been spent on Y2K remediation.

- Rising interest rates: Due to low interest rates, which was been going since 1994 which resulted in increasing of inflection. Because of that reason FED had to increase the interest rates.

Due to those 2 threats, Nesdaq was suddenly fallen from the peak of 5048 to 1139. So due to this sell-off, more selling was rapidly increased and on the other hand pressure was increased to those internet companies because fund was not coming from investors.

Many companies started feeling the cash crunch as they did not have the product or they didn't have actual growth to show ( Revenues). That caused them bankruptcy.

So that was the scenario of Dotcom bubble bust. I hope you enjoyed the blog, follow me for more such content. I'll see you later.